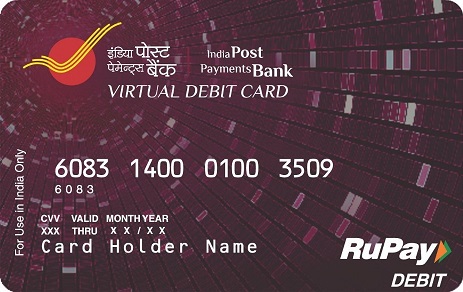

IPPB RuPay Virtual Debit Card

Debit cards are one of the most popular instruments these days for cashless transaction & already a prominent mode for payment adopted in India. With growing business of Ecommerce/ Online services in India, usage of debit card on ECOM/ Online merchant transactions are increasing significantly, day by day.

India Post Payments Bank (IPPB) presents RuPay Virtual Debit Card to promote Government of India’s digital payments mission and encouraging customers / merchants to shift towards digital payments mode.

Key Features

IPPB RuPay Virtual Debit Card is a digital debit card which can be generated by the customers on their mobile banking App. It allows IPPB customers to do digital transactions on ecommerce/ online websites for purchasing of goods/ services/ paying bills etc. on RuPay enabled portals/ payment gateways.

Some additional features of the card are as below:

- Card can be Self - Generated, Blocked, Unblocked from IPPB Mobile Banking App.

- Individuals can set their own per day limits.

- Acceptance on all RuPay enabled e-commerce site/ merchant site

- Attractive e-commerce offers, cashback on paying utility bills, instant discounts etc.

-

Please refer below table for more information.

|

Card Variant |

RuPay Classic |

|

|

Daily purchase limit (e-commerce) |

Minimum |

Rs. 1 |

|

Maximum (per card) |

Rs. 50,000* |

|

|

Issuance charges |

Rs. 25 (inclusive of GST/ CESS) |

|

|

Usage/ Transaction charges (e-commerce) |

NIL |

|

|

Reissuance charges |

NIL |

|

|

Blocking/ Unblocking charges |

NIL |

|

*For DGSBA accounts a cumulative monthly transaction limit of Rs. 10,000 is applicable only for Bill Payments, In store Merchant Payments and Payment towards eligible Post Office Savings Schemes and Services.

Grievance Handling/ Card Hotlisting in assisted Mode

Customer may approach to IPPB on below channels:

1. Branch/ Access Point

2. Toll Free Customer Care No. - 1800 8899 860