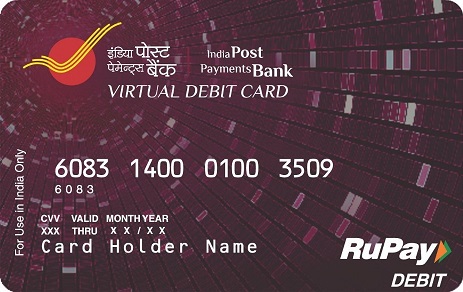

IPPB RuPay Virtual Debit Card

Debit cards are one of the most popular instruments these days for cashless transaction & already a prominent mode for payment adopted in India. With growing business of Ecommerce/ Online services in India, usage of debit card on ECOM/ Online merchant transactions are increasing significantly, day by day.

India Post Payments Bank (IPPB) presents RuPay Virtual Debit Card to promote Government of India’s digital payments mission and encouraging customers / merchants to shift towards digital payments mode.

Key Features

IPPB RuPay Virtual Debit Card is a digital debit card which can be generated by the customers on their mobile banking App. It allows IPPB customers to do digital transactions on ecommerce/ online websites for purchasing of goods/ services/ paying bills etc. on RuPay enabled portals/ payment gateways.

Some additional features of the card are as below:

- Card can be Self - Generated, Blocked, Unblocked from IPPB Mobile Banking App.

- Individuals can set their own per day limits.

- Acceptance on all RuPay enabled e-commerce site/ merchant site

- Attractive e-commerce offers, cashback on paying utility bills, instant discounts etc. Click here for more information.

- Please refer below table for more information.

|

Card Variant |

RuPay Classic |

|

|

Daily purchase limit (e-commerce*) |

Minimum |

Rs. 1 |

|

Maximum (per card)$ |

Rs. 1,00,000 |

|

|

Issuance charges |

Rs. 25 (inclusive of GST/ CESS) |

|

|

Usage/ Transaction charges (e-commerce*) |

NIL |

|

|

Reissuance charges |

Rs. 25 (inclusive of GST/ CESS) |

|

|

Annual Maintenance Charges |

Rs. 25 (inclusive of GST/ CESS) |

|

|

Blocking/ Unblocking charges |

NIL |

|

*E-commerce transaction shall be enabled after 24 hours of virtual debit card activation.

$Default limit will be Rs.50,000. However, customers can change it upto Rs. 1,00,000 in Mobile Banking application.

Card Tokenization

- RBI has directed the payment aggregators, wallets and online merchants (entities in card transaction/payment chain other than card issuers/card networks) to not store any sensitive card related customer information including full card details. Hence, the card details can be replaced with tokens. Please be assured that this will not hamper your card transaction experience but will make your card transactions more secure.

- The Debit card shall be tokenized at the Ecommerce merchant website/ Mobile application. Customer consent would be obtained by the Ecommerce merchant along with OTP authentication prior to Debit card tokenization.

- Wef 01st October, 2022, to pay each time, enter full card details or opt for tokenization.

Features:

- Card details cannot be saved by merchants Payment Gateway.

- Different Token for different merchants/ platforms.

- Existing OTP authentication will continue.

Eligibility Criteria:

For all Customers having IPPB account.

Benefits:

- Convenient in case of fraud or theft as multiple tokens are issued for the same card payment on different platforms and no storage of actual card.

- Convenient and safe recurring payments.

- Option to link renewed / replaced cards with existing merchants to ensure the checkout experience is not disrupted with card lifecycle changes.

Grievance Handling/ Card Hotlisting in assisted Mode

Customer may approach to IPPB on below channels:

1. Branch/ Access Point

2. Customer Care No. - 155299 or 033-22029000

3. Dedicated Toll Free no for Card Hotlisting. - 1800 8899 860